3 Steps Closer to Reaching Your Saving Goals

We’re still riding the New Years’ Resolution buzz and hope you are too! It’s a great opportunity to focus the momentum of a new beginning into some truly productive movements for 2019, starting with creating a Savings Goal that will get you one step closer to living a financially balanced life.

We know how hard it can be to regularly put money aside and stick to your saving plan, which is why we provided a tool in Online Banking to help keep you on target.

In less than 1 minute (that’s right, we’ve timed it!) you can create a Savings Goal with built in tracking.

Follow these 3 Simple Steps toward easy saving

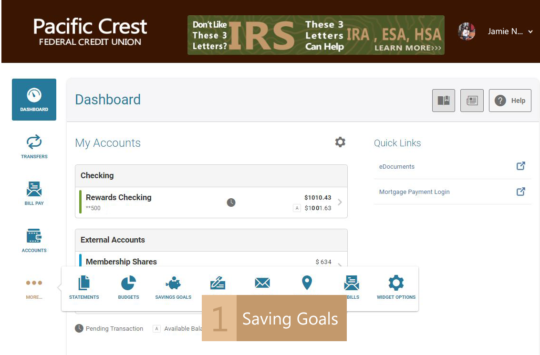

1) Once you log into Online Banking, beneath the “more” tab select “Savings Goals”

This will take you to the Saving Goals Dashboard. Here, you will see your various savings accounts (your checking accounts/loan balances will not be options) and you can choose which savings account you would like to assign each goal to. Choose the “New Goal” option next to the savings account you want to use.

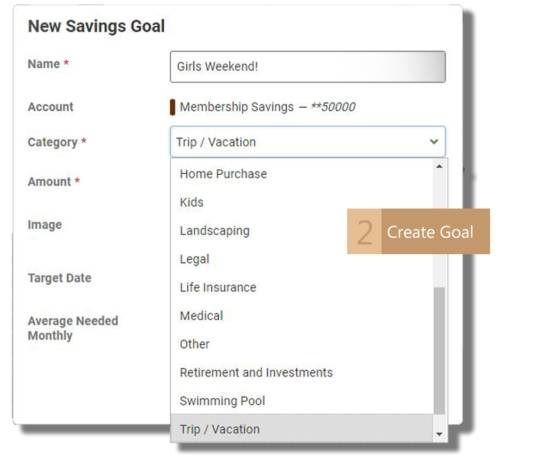

2) Create your Savings Goal

A window will pop up asking you to name your goal, you can have a little fun with the name if you think it might help your motivation.

You are then asked to assign your goal to a category and input the amount you wish to save. You also have the option to select the target date. This is not required to create the goal, but we find that having a deadline can help encourage you to save as it creates a sense of urgency.

What’s also great about setting a target date is that the Average Needed Monthly is then generated, giving you an idea of how much you should put towards the goal each month to stay on track.

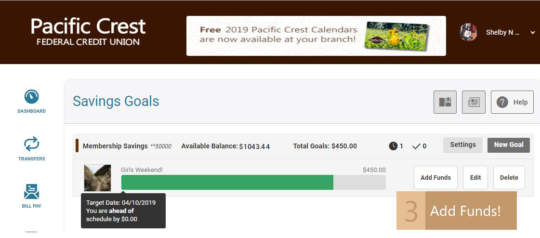

3) Start adding funds!

Being visual creatures, we can all appreciate the satisfaction that comes with watching our green bar grow closer and closer to our goal

Having projected minimums also helps you know if you should alter your monthly budget to make room for your Savings Goals (don’t worry, we’ll fill you in on our new budgeting tool soon!).

The app will let you know if you’re ahead of your goal, which is a nice pat on the back if you need some affirmation, or if you’re starting to fall behind. Either way, you’ll be reminded that your goal exists and that you should keep taking actionable steps towards making it happen.

If you would like more in-depth help with your financial situation, like preparing a budget, developing a plan for getting out of debt, or preparing for the future, call us to set up an appointment. Our Financial Counselors are friendly and experienced, and most importantly can’t wait to help you find your path.

Check out this new tool and start turning your 2019 dreams into your 2020 memories! If you would like to try the savings tool but don’t have an account with us or don’t have Online Banking, call our team at 800.570.0265 or visit us at your closest branch!